Mortgage calculator maximum loan

Home buyers must put at least 35 percent down on an FHA loan. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination.

Online Mortgage Calculator Wolfram Alpha

Mortgage payment The monthly mortgage payment is calculated based on the inputs you provided.

. When you put at least 20 down on a conventional loan or 20 home equity on a refinance you can avoid paying monthly private mortgage insurance premiums PMI. Avoid private mortgage insurance. Loan amountthe amount borrowed from a lender or bank.

A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan. With the maximum origination fee allowable under HUD rules reflected for illustrative purposes only along with an estimated FHA Mortgage Insurance Premium for a loan based upon the home value provided and estimated recording fees and taxes and other types of closing costs typically associated with a reverse. To determine what is affordable for you and your family determine first the maximum monthly mortgage payment and maximum loan amount you can comfortably pay.

This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI. Skip to main content. Income If you calculate based on income the calculator will take information about your financial health and loan preferences combined with projected taxes and insurance to provide an estimate.

The number of years over which you will repay this loan. Minimum and calculatorhousemaxPrice currency0 maximum. The information provided on this website is for general education.

Actual payment amounts may differ and will be determined at the time of signing the Mortgage Loan Agreement. The mortgage amount rate type fixed or variable term amortization period and payment frequency. Continental baseline is 647200.

The Canadian Mortgage Calculator is mainly intended for Canadian residents and uses the Canadian dollar as currency with interest rate compounded semi-annually. The loan is secured on the borrowers property through a process. These are also the basic components of a mortgage calculator.

Second mortgage types Lump sum. Malaysia home loan eligibility calculator to calculate your maximum housing loan amount in 2021 based on your annual income and ability to service the loan. A mortgage usually includes the following key components.

The Loan term is the period of time during which a loan must be repaid. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. The loan life is predetermined to ensure maximum profits.

The maximum loan amount one can borrow normally correlates with. The maximum mortgage calculator will allow you to input your monthly obligations your monthly income to calculate the maximum monthly mortgage payment. As of 2022 the maximum conforming limit for single-family homes throughout the US.

The most common mortgage terms are 15 years and 30 years. A general affordability rule as outlined by the Canada Mortgage and Housing Corporation is that your monthly housing costs should not exceed 32 of. Use the TD mortgage affordability calculator to determine a comfortable mortgage loan and price range for your new home.

Refinance rates valid as of 31 Aug 2022 0919 am. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. TD Mortgage Affordability Calculator.

The most common fee is 1 though the maximum loan origination fee is 3 on Qualified Mortgages of 100000 or more. Press spacebar to show inputs. Up debt into levels of three item indices can help the customer decide on whether to partake in a real estate with a loan.

Adjust the home price loan term down payment and interest rate to find the right mortgage fit for your budget. Use our calculator to estimate your monthly mortgage payment including principal interest property taxes homeowners insurance and even private mortgage insurance if its required. These fees are typically incremented by half-percent.

ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for. About home loan specialists. Mortgage Repayment Calculator Australia.

An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the. The mortgage term is the length of time you commit to the terms conditions and mortgage rate with a specific lender. A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses.

A mortgage calculator can help you estimate how long it will take to break even if youre thinking about buying down your interest rate by paying points or fees. Additional conditions may apply. Thats because FHAs maximum loan-to-value ratio is 965 percent meaning your loan amount cant be more than 965 percent.

Calculation assumes constant interest rate throughout. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. For example if your loan amount is 620000 your mortgage is considered a conforming conventional loan.

Conforming limits are adjusted every year by the FHFA. Total of 300 Mortgage Payments. The calculator is for residential properties and mortgages.

If youre putting 20. Mortgage type The mortgage type includes the term of the mortgage between 1-10 years and the rate type variable or fixed. For instance the buyer could consider a scale from 1 to 3 where 1 is productive debt and 3 is an unproductive debt.

For example a 30-year fixed-rate loan has a term of 30 years. Make sure to check their website to know the current loan limits. Maximum loan-to-value ratio The loan-to-value ratio LTV of a loan reflects how big the mortgage is in relation to the value of the home youre financing.

Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. Second mortgages come in two main forms home equity loans and home equity lines of credit. Smaller homes may see a higher origination fee on a percentage basis since the mortgage broker will need to do a similar amount of work for a smaller loan amount.

In a mortgage this amounts to the purchase price minus any down payment. Mortgage loan payment calculatormortgagemonthly calculatorinsurancetotaltotal. The term must be a minimum of 6 months and a maximum of 10 years.

Chases mortgage affordability calculator creates an estimate of what you can afford and what your mortgage payments may be based on either. Lenders look most favorably on debt-to-income ratios of.

5 Best Mortgage Calculators How Much House Can You Afford

Home Affordability Calculator For Excel

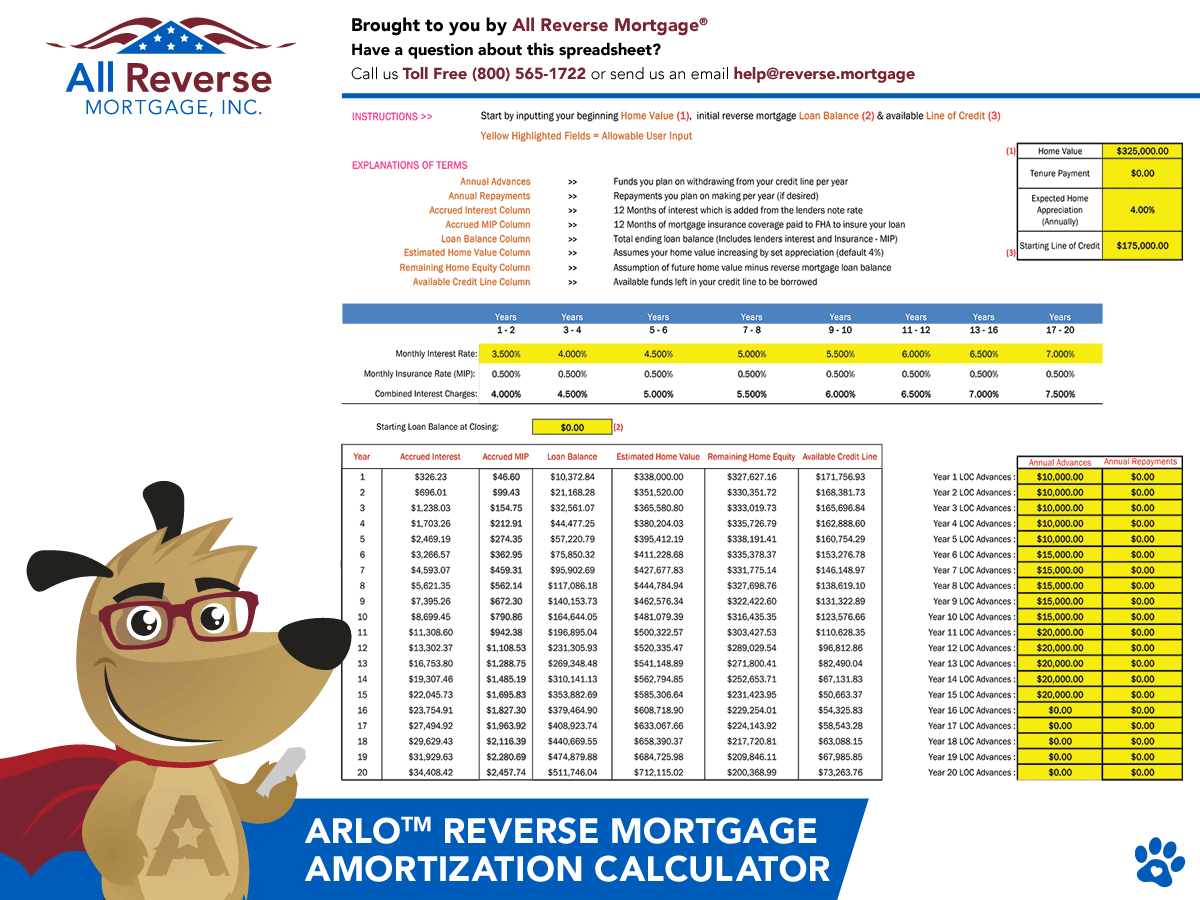

Free Reverse Mortgage Amortization Calculator Excel File

5 Alternative Ways To Use A Mortgage Calculator Zillow

Discount Points Calculator How To Calculate Mortgage Points

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Advanced Loan Calculator

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Va Mortgage Calculator Calculate Va Loan Payments

Va Loan Calculator

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Extra Payment Mortgage Calculator For Excel

Downloadable Free Mortgage Calculator Tool

Mortgage Calculations Using Ba Ii Plus Youtube

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel